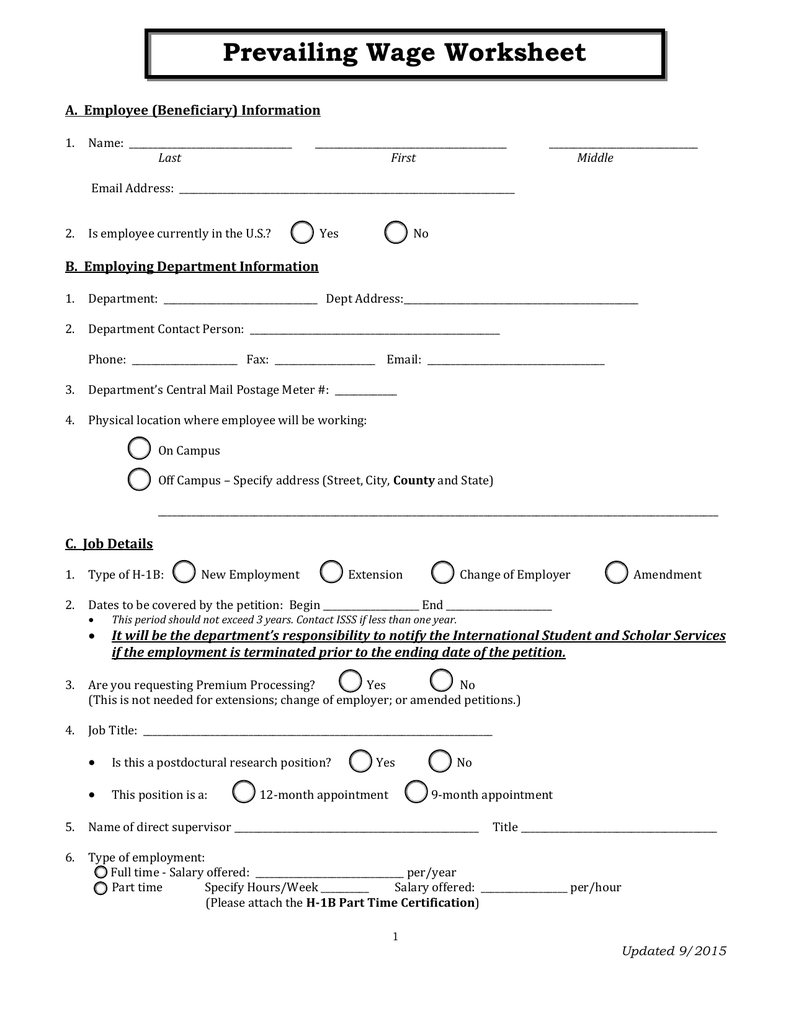

Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. I certify that the above information represents the wages and supplemental benefits paid to all. Missouri prevailing wage request form. Prevailing wage complaint form print in ink or type your responses. We don't support prevailing wages or certified payroll reports. What is onduty as per employee compensation act. Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. Enter total payroll for the employee to include the project and all other wages earned for the week. The prevailing wage rate schedules developed by the u.s. The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker.

Minnesota department of small works public works contract ($2,500 or less including tax) statement of intent to pay prevailing wages & affidavit of wages. I certify that the above information represents the wages and supplemental benefits paid to all. Missouri prevailing wage request form. The prevailing wage rate schedules developed by the u.s. 0 ratings0% found this document useful (0 votes). Learn about prevailing wages and certified payroll reports. To get the proper rates for your region/job, you must request a determination. We don't support prevailing wages or certified payroll reports. What are california prevailing wage laws? The prevailing wage laws state that contractors are responsible for their subcontractors.

The prevailing wage rate schedules developed by the u.s.

Prevailing wage complaint form print in ink or type your responses. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes. I have a existing xls file that i need to write to. The prevailing wage laws state that contractors are responsible for their subcontractors. A form for certifying payrolls when a standard state or federal certified payroll form is not used. Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format! It opens a workbook, goes down the rows, if a condition is met it writes some data in the row. Number of days to accrue f. The excel pay roll workbook is very good. Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. They must report these wages on certified payroll reports. Minnesota department of small works public works contract ($2,500 or less including tax) statement of intent to pay prevailing wages & affidavit of wages. Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. A fundamental methodology within us payroll for comparing payroll actual pay and fringe rates to prevailing wage and fringe rates, and calculating net difference adjustments. Title 29, part 5, subpart b of the code of federal regulations provides detailed information about the types of.

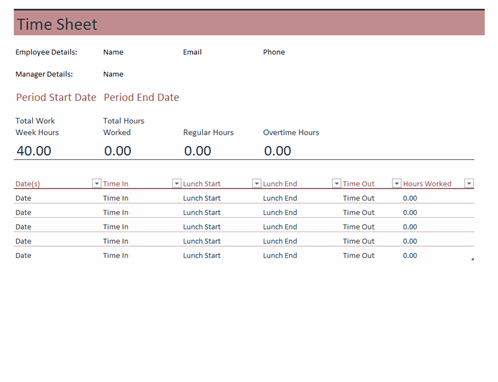

The excel pay roll workbook is very good. Forms used to process prevailing wages. Learn about prevailing wages and certified payroll reports. What are california prevailing wage laws? Dls issues prevailing wage schedules to cities, towns, counties, districts, authorities, and state agencies. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. Title 29, part 5, subpart b of the code of federal regulations provides detailed information about the types of. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions.

Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm.

Learn about prevailing wages and certified payroll reports. What is certified payroll and prevailing wage? Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job. What is onduty as per employee compensation act. Enter total payroll for the employee to include the project and all other wages earned for the week. The access version posted by abi_vas has a bug in the programme. The excel pay roll workbook is very good. Dls issues prevailing wage schedules to cities, towns, counties, districts, authorities, and state agencies. Prevailing wage intent & affidavit instructions search all messages use the search a keyword prevailing wage intent & affidavit instructions 2. When i use xlrd to read the file, i cant seem to figure out how to transform the book type returned into a xlwt.workbook.

The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. Submit a certified payroll report notice: Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. I have a existing xls file that i need to write to. What are the procedure for esi non implemented area. Learn about prevailing wages and certified payroll reports.

Prevailing wage schedules and updates.

Violators must pay workers the difference between the wage paid and the prevailing wage, and are subject to penalties and punitive damages. Missouri prevailing wage request form. In accordance with section 4115.071(c) of the ohio revised code, listing of payroll dates, i hereby submit the following schedule of dates that my company is required to pay wages for its workers. We don't support prevailing wages or certified payroll reports. Some document may have the forms filled, you have to erase it manually. Forms used to process prevailing wages. Percentage of payroll to accrue. Prevailing wage master job classification. Prevailing wage log to payroll xls workbook / payrolls office com. Submit a certified payroll report notice:

Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format!

What are the procedure for esi non implemented area.

Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm.

I certify that the above information represents the wages and supplemental benefits paid to all.

Prevailing wage master job classification.

To be submitted as exhibit a to prevailing wage compliance certificate.

Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Reviewing prevailing wage dba range.

fill in all blank items.

I certify that the above information represents the wages and supplemental benefits paid to all.

Available for pc, ios and android.

The excel pay roll workbook is very good.

0 ratings0% found this document useful (0 votes).

Forms used to process prevailing wages.

To get the proper rates for your region/job, you must request a determination.

Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it.

The prevailing wage laws state that contractors are responsible for their subcontractors.

Users have been experiencing difficulty when using the internet.

Users have been experiencing difficulty when using the internet.

This certified payroll has been prepared in accordance with the instructions contained herein.

Use these free templates or examples to create the perfect professional document or project!

The prevailing wage laws state that contractors are responsible for their subcontractors.

Prevailing wage intent & affidavit instructions search all messages use the search a keyword prevailing wage intent & affidavit instructions 2.

Department of labor, based upon a geographic location for a specific class of labor and type of project.

What is certified payroll and prevailing wage?

Prevailing wage log to payroll xls workbook / payrolls office com.

Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Prevailing wage intent & affidavit instructions search all messages use the search a keyword prevailing wage intent & affidavit instructions 2.

The access version posted by abi_vas has a bug in the programme.

Available for pc, ios and android.

The prevailing wage unit assists prime contractors and subcontractors who perform work on certain (see below) state or political subdivision construction contracts exceeding $500,000.

Reviewing prevailing wage dba range.

Prevailing wage log to payroll xls workbook / payrolls office com.

To get the proper rates for your region/job, you must request a determination.

0 Komentar